|

| Profit margins may get squeezed by austerity |

US asst manager GMO published a commentary about historically high profit margins by Charles Montier titled

"What Goes Up, Must Come Down" and explains some interesting details:

- Profit margins are on historical highs (and Wall Street analysts still forecast increasing margins)

- Driver of the surge in profit margins were a combination of strong demand due to high government spending which and of decreased costs due to lower wages (globalization and outsourcing).

| | |

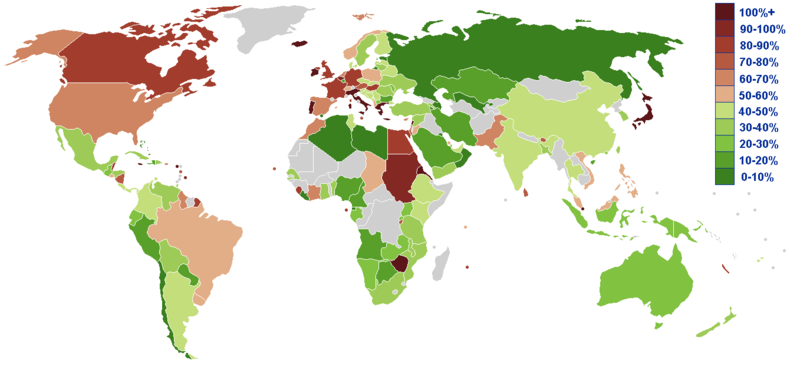

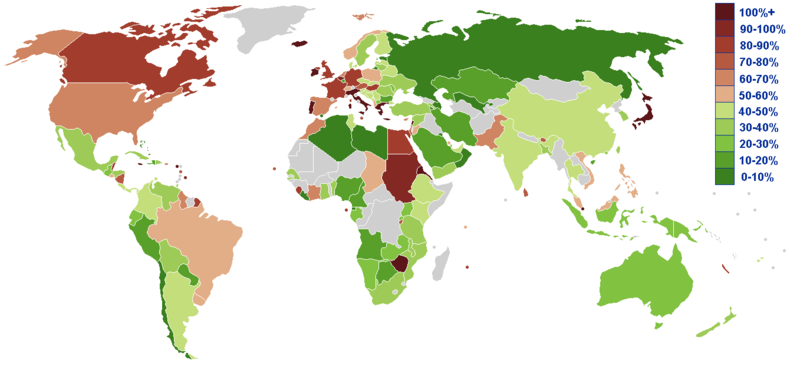

| Public debt world map from Wikipedia |

In many developed countries, public debt is sky high. Wikipedia has a nice

list of every countries public debt.

Conclusion

In the medium term, we are stepping towards fiscal consolidation, since public debt levels are not sustainable in the long run. Hence, we have to expect that profit margins will revert to the mean (as they always did). That will spell a huge disappointment for stock holders!